Observing recent market activity, it is evident that several shifts have already occurred this year. Looking ahead, the latest expert projections provide valuable insight into what may be expected in terms of home prices, mortgage rates, and the potential implications for buyers and sellers in 2025.

Home Price Outlook

While many prospective buyers are anticipating a decrease in home prices, and some localized declines have been reported, it is important to consider the data. Although the rate of home price appreciation has slowed, there is no indication of an imminent market crash. As explained by the National Association of Home Builders (NAHB):

“House price growth slowed . . . partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on house prices. These factors signaled a cooling market, following rapid gains seen in previous years.”

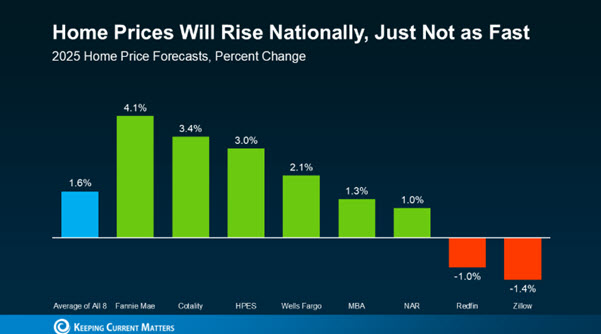

Despite this moderation, leading industry forecasters collectively predict home prices will rise nationally by approximately 1.5–2% in 2025.

Thus, expectations of a significant price drop are not supported by current expert analysis. Average price decreases in certain markets are limited to about -3.5%, a figure considerably less severe than the nearly 20% downturn experienced during the 2008 recession. Moreover, substantial gains over the past five years—evidenced by Federal Housing Finance Agency data showing a 55% national increase—continue to underpin the market. In summary, prices are expected to continue rising at a slower pace, with variation depending on location; consulting a real estate professional remains advisable for specific market trends.

Mortgage Rate Expectations

Many buyers are considering postponing their purchase in hopes of lower mortgage rates. However, this approach may not yield the desired results. According to Yahoo Finance:

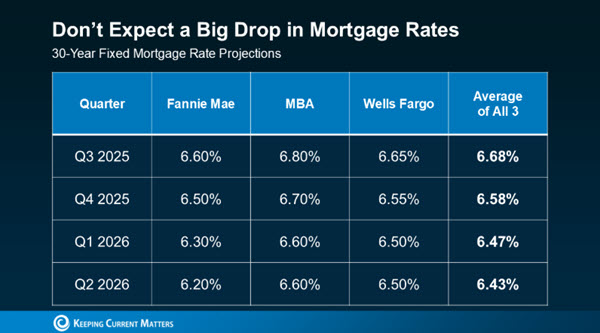

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting. The latest news from the Federal Reserve and other key economic data point toward steady mortgage rates on par with what we see today.”

Most experts forecast mortgage rates to remain in the six percent range, with projections placing them at a mid-6% average by year-end. This is consistent with present levels, suggesting minimal change is likely. Consequently, individuals with immediate housing needs should weigh the risks of delaying action against the improbability of significant near-term rate reductions. Collaborating with a knowledgeable professional who monitors economic indicators affecting mortgage rates, such as inflation and other contributing factors, will be essential for making informed decisions.

Key Considerations for Buyers and Sellers

Whether your goal is to buy, sell, or undertake both, today’s real estate landscape demands a thoughtful and strategic approach. With national prices trending upward—albeit at a modest pace—and mortgage rates projected to remain relatively stable, the overarching environment is one of moderation rather than volatility.

Conclusion

For those contemplating a move, it is advisable to prioritize individual circumstances over media narratives. Please feel free to reach out for a discussion regarding your unique situation and how best to navigate the evolving market conditions.

Source: Real Estate with Keeping Current Matters